Affordable, Quality Home Appraisals

Certified FHA appraiser, 20+ years of experience.

Contact US

Landsman Appraisal LLC - Market Trends Experts

- Phoenix, Arizona, United States

- Call Anytime!

Call to speak directly with Darin Rogers and have your questions answered. (If Darin is driving or working on a house, it may be necessary to leave a voicemail, or you can send a text. Either way, the response will be prompt and courteous.) Thank you! ↓ SCROLL FOR MORE INFO ↓

SERVICES

Full Appraisals

The most popular option, these are excellent for estate, divorce or bankruptcy situations, whether or not litigation may be involved. These are similar in scope to appraisals you may have had done for a home purchase or refinance. It usually takes 30-60 minutes to measure the dwelling, take photos, and gather general information, and another 2 - 5 calendar days to produce the report (next-day appraisals are subject to availability).

Exterior-Only Appraisals

These are also known as "drive-by" appraisals, but please be assured, we always stop and take a good look, and take front, street, and side view photos. These appraisals are a more affordable option, and don't require an appointment. Observations are from the street and also from other sources such as county records, aerial photography, MLS and other listings, and Google Earth™ .

Restricted Use Appraisals

Tailored to your specific needs. For instance, if you just need a bottom line, no-frills value opinion from an experienced appraiser, in a less formal style compared to a full appraisal, it can be done inexpensively with a Desktop appraisal. Also, we perform measurement-only services, if you just need an accurate floor plan with dimensions and room locations. Photography-only services are offered as well, for insurance purposes, for example.

F.A.Q.

Why not use free online estimates instead of getting a proper appraisal?

What are your qualifications?

How does the appraisal process work?

How much will the appraisal cost? Are there any other fees?

I'm considering a cash offer for my house from an investor, without listing it on MLS first. Is it likely I'll get a fair deal?

Can you explain the different types of appraisals you offer?

What is the difference between a home inspection and an appraisal?

How about a photo of you, so we can be sure the person who shows up is really you?

Arizona resident since 1973. Go Suns!

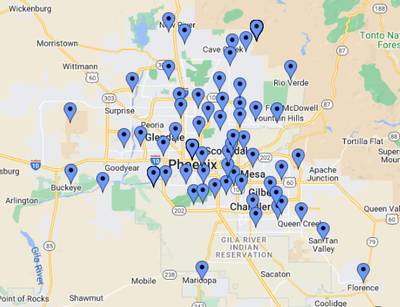

Arizona resident since 1973. Go Suns!Service area

landsman news roundup

Market Experts Weigh In

NAR Pending Home Sales Report Shows 9.3% Decrease in December

Pending home sales in December decreased by 9.3% from the prior month and 3.0% year over year, according to the the National Association of REALTORS® Pending Home Sales Report. The report provides the real estate ecosystem – including agents and homebuyers and sellers – with data on the level of home sales under contract.

Read More

4 Phoenix suburbs rank among fastest-growing and most affordable in U.S.

A new ranking of America’s fastest-growing affordable suburbs is giving a better idea of just how influential the Phoenix Metro is on the national stage. Four Metro Phoenix suburbs rank among the fastest-growing and most affordable suburbs with home values under $500,000.

Read More

ICE raids hurting construction industry, leaders say

Over 9,000 people have been arrested by U.S. Immigration and Customs Enforcement agents this past year in Texas’ Rio Grande Valley, according to construction industry officials who say workers are being targeted as the industry is hurting for labor.

Read More

Here is the outlook for Phoenix’s 2026 housing market

As Phoenix enters 2026, the housing market is predicted to continue to recover from the whiplash cycles of the early 2020s. Closed sales have risen from their post-pandemic lows, mortgage rates have stabilized enough for buyers to negotiate, and the Valley’s long-stagnant inventory is beginning, slowly, to shift.

Read More

The Decline of the Appraisal Industry: An Unsustainable Future

AppraisersForum: Once a cornerstone of real estate transactions, the appraisal industry is now facing an existential crisis. A closer look reveals a troubling disparity between the compensation appraisers receive and the escalating demands placed upon them. This unsustainable imbalance is threatening the viability of the profession.

Read More

Arizona Real Estate Market Statistics

ArizonaRealEstate.com: Here you'll find statistics on residential listings in Arizona and surrounding communities, updated every day from the MLS, including the average price, average days on market, average price reduction, and more.

Read MoreTestimonials

Richard Presto

Client for retrospective estate appraisalI hired Landsman Appraisal Services to do a home appraisal for tax purposes. Darin Rogers arrived at the house right on time and did a very thorough inspection of the premises. I received the report within several days and I was pleased with the report and the back up data supporting the valuation. I had contacted several companies and Landsman had the most reasonable price. I would highly recommend Landsman for their prompt and courteous services. And the report I received was professionally done. Many thanks to Landsman Appraisal, LLC!

Mike Woodard

Client for pre-refi appraisalWe considered several appraisers and Darin Rogers seemed the most professional. He took the time to explain each piece of the valuation process, answered all of our questions, and even offered some advice about how we might increase the value of our home. He was objective and fair in his assessment. I would highly recommend Darin Rogers for a timely and professional appraisal.

Kevin Knaussman

Client for asset valuation appraisal (considering selling)Mr. Rogers was on time, very thorough while he was at the house, and he asked me about all the work I've done to it, which I was glad because appraisers don't always do that. The report was easy to understand and the estimate was right on the money, based on recent sales that have since happened on my street. The sketch was useful to say one way or the other, about a room which I wasn't sure if it counted as part of the square footage or not. Anyway, I would recommend them to anyone because they did a good job for me.

Matthew Gismondi

Real Estate InvestorI called Landsman Appraisal to get a good idea of what my property was worth after I finished renovation of a rental property in the Arcadia area. I’m a real estate investor who was considering a cash-out refi. Landsman completed the appraisal on time and did a great job with a great set of pictures. They performed a thorough evaluation of relevant neighboring properties in an area that can be tricky. Later, when I was between tenants and was making the decision whether to sell or rent again, Landsman updated the appraisal, doing a desktop evaluation which included neighboring properties, which had all gone up in value. My property was an unusual parcel, involving a subordinate property with a different owner and an easement across my parcel, but Landsman’s appraiser knew how to handle it. In short, I know Landsman works with lots of big banks and mortgage companies, but they were also responsive to a private-party appraisal with a quick turn-time. I heartily recommend Landsman Appraisal to investors and homeowners alike.